It’s a question many people ask: Where does our tax money actually go? We know it funds roads, schools, and the military, but what about programs like EBT, or Electronic Benefit Transfer, often referred to as food stamps? EBT provides financial assistance to individuals and families in need, allowing them to purchase food. Understanding how these programs work, and if they’re supported by our tax dollars, is important for everyone. This essay will explore the relationship between taxes and EBT, helping to answer the question: Do our tax dollars go to EBT people?

How EBT Works

Yes, a significant portion of the funding for EBT programs comes directly from federal and state tax revenue. These funds are allocated through the Supplemental Nutrition Assistance Program (SNAP), which is the official name for the program that provides food assistance to eligible individuals and families. The money is used to provide benefits, typically in the form of a debit card, that can be used to buy groceries.

Eligibility for EBT

Who is eligible to receive EBT benefits? The requirements vary by state, but there are some general guidelines. Eligibility is usually determined by income and resources. This means the amount of money a household earns, as well as any assets like savings or property, are considered. Families and individuals must meet certain income thresholds to qualify for the program.

There are also work requirements in some states. Able-bodied adults without dependents may be required to work or participate in a job training program to receive benefits. These rules are designed to encourage self-sufficiency and help people find employment. However, they can be complex and vary based on individual circumstances.

Here’s a brief overview of some factors that are often considered when determining eligibility:

- Household Income

- Household Size

- Asset Limits (savings, property)

- Work Requirements (in some states)

It is important to remember that EBT is intended to be a temporary assistance program, helping people meet their basic needs while they work towards financial independence. It’s a safety net designed to help people get back on their feet during difficult times.

How Taxes Fund EBT

As mentioned earlier, tax dollars are the primary source of funding for EBT programs. Both the federal government and state governments contribute to the funding. The federal government usually covers a larger portion of the cost, while states contribute a smaller percentage, and also handle the administration of the program.

The federal funding comes from general tax revenues, which means money collected from various sources, including income taxes, payroll taxes, and corporate taxes. This money is then allocated by Congress to fund various programs, including SNAP. This process involves budgeting and appropriations, where lawmakers decide how much money will be spent on different programs.

States often use their own tax revenues to cover their share of the program costs. They might also use money from other state sources, like lottery revenues, to help fund EBT. The specific funding mechanisms can vary from state to state.

Here’s a simple breakdown of how tax dollars are typically used:

- Federal Taxes: Funds are collected through various sources, and then allocated by Congress to fund federal programs, like SNAP.

- State Taxes: States contribute a portion of the funding for EBT, using their own tax revenues.

- Administration: Funding covers the costs of running the program, including salaries, technology, and office space.

- Benefits: The money is used to provide EBT cards to eligible participants.

The Impact of EBT on the Economy

EBT programs can have several effects on the economy. When people use their EBT benefits to buy groceries, this helps support local businesses like grocery stores and farmers markets. This spending stimulates economic activity and can create jobs within these businesses. The money circulates through the economy, as store owners use their revenue to pay employees, buy supplies, and invest in their businesses.

Some argue that EBT also helps stabilize the economy during economic downturns. By providing a safety net, EBT can help prevent a further decline in consumer spending. This can help to keep businesses afloat and prevent widespread job losses. Because the money gets spent quickly, it helps get money flowing through the economy when people need it most.

Conversely, there can be some negative views about the impact of EBT. Some people worry about the cost of the program and its impact on the federal budget. It is important to remember that these costs are often offset by the economic activity that EBT generates.

Here’s a look at some potential economic effects:

| Positive Impacts | Negative Impacts |

|---|---|

| Supports local businesses | Cost of the program |

| Stimulates economic activity | Potential for fraud |

| Stabilizes the economy during downturns | Can discourage work (debatable) |

Misconceptions About EBT

There are many misconceptions about EBT. Some people believe that the program is rife with fraud, while others believe it is only used by people who are unwilling to work. These are unfair stereotypes, and the reality of EBT use is often more nuanced. There are efforts in place to prevent fraud, and the vast majority of EBT recipients are working families or individuals who are temporarily struggling.

Another common misconception is that people abuse the system to purchase unnecessary items. While there are restrictions on what can be purchased with EBT benefits, many people do use their benefits to buy necessary food items. The program is designed to provide basic nutritional support. Moreover, most participants are hard-working people who need temporary help.

It’s important to get your information from reputable sources. Look into what data the government has about fraud. Learn about the rules of the program and who qualifies. If you want to better understand how the system works, you need to learn more, not less. This can help break down these harmful assumptions.

Here are some common myths and the realities:

- Myth: EBT is full of fraud.

- Reality: Fraud rates are relatively low, with measures in place to prevent it.

- Myth: EBT recipients are lazy and don’t want to work.

- Reality: Most recipients are working families or individuals facing temporary hardships.

- Myth: EBT can buy anything.

- Reality: EBT benefits are restricted to food purchases.

The Debate Over EBT Spending

The amount of money spent on EBT is a topic of debate. Some people argue that the program is too expensive and should be reduced or reformed. They may believe that it disincentivizes work or that the benefits are too generous.

On the other hand, supporters of EBT argue that the program is essential for providing food security and reducing poverty. They may argue that the program is a good investment in society. Plus, they might emphasize the economic benefits of the program, such as supporting local businesses and stimulating the economy.

These arguments about the program often involve political and economic factors. There are some who suggest that there is a need for additional funding for the program, while others want to keep it at current levels or reduce it.

Some areas that are heavily debated concerning the program are:

- The level of funding.

- Eligibility requirements.

- Work requirements.

- The types of foods that can be purchased.

Looking at the Future of EBT

The future of EBT is always changing. The program is constantly being evaluated and adjusted to meet the needs of its participants and the changing economic climate. There are ongoing discussions about how to improve the program, make it more efficient, and ensure that it is effective in helping people in need.

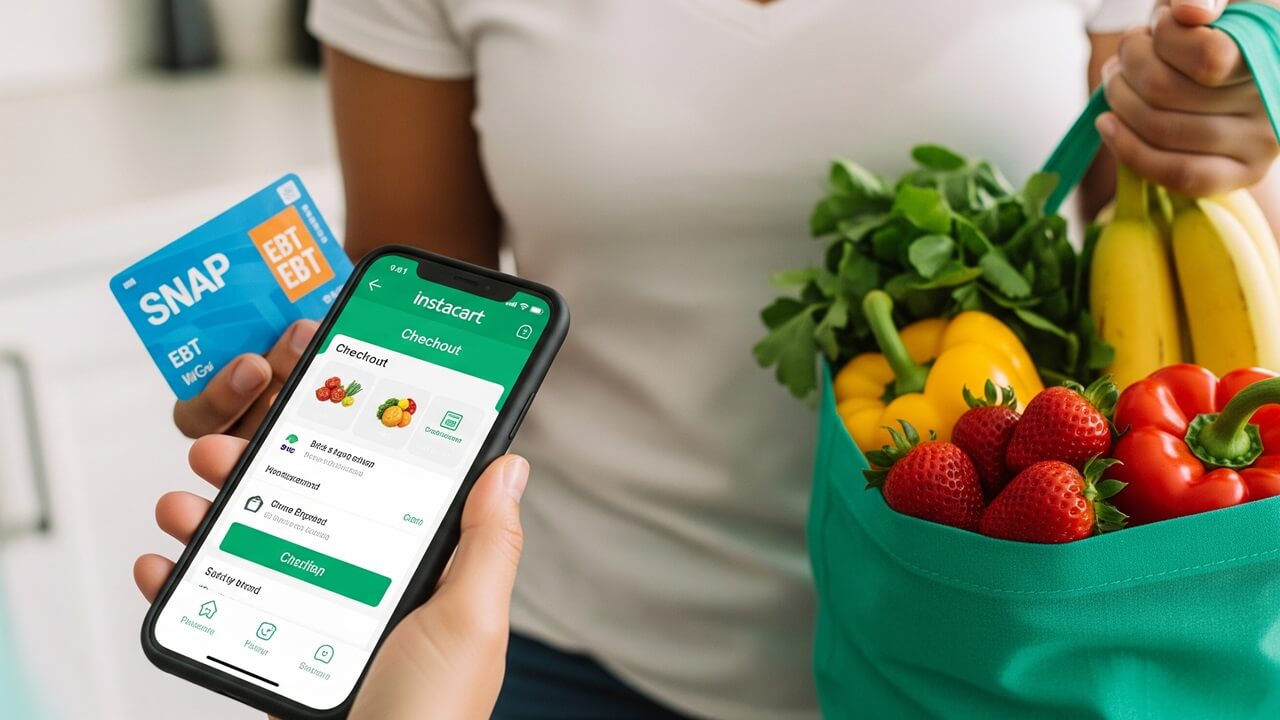

One area of focus is on how technology can improve the program. Efforts are being made to simplify the application process and provide more convenient access to benefits. This includes looking at mobile apps, online portals, and other technologies.

Another area of development is the focus on how EBT works in conjunction with the workforce. There is ongoing research and exploration on different policies to help ensure that EBT is working effectively. There are also programs designed to help EBT recipients find jobs and become financially independent.

Here are some potential future trends:

- Increased use of technology

- Focus on workforce development

- More emphasis on nutrition and healthy eating

The program can undergo significant shifts, influenced by political changes, economic conditions, and the needs of those served by the program.

Conclusion

In conclusion, the answer to the question, “Do our tax dollars go to EBT people?” is a definitive yes. EBT is funded primarily through federal and state tax revenues, demonstrating a direct link between taxes and this important social safety net program. Understanding how this program works, who is eligible, and the various impacts it has can help us to make informed decisions about its future. EBT is a complex program, and it is essential to have a well-rounded perspective on the program when forming your opinion on it.